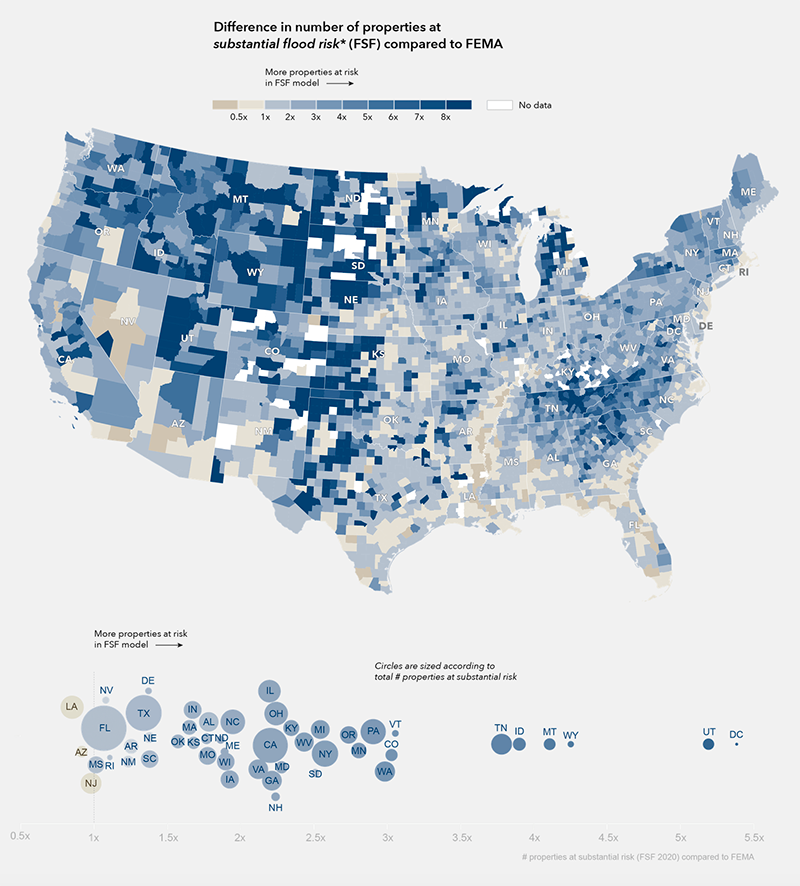

Will your home face flooding due to climate change? A new study by the New York-based nonprofit First Street Foundation found that 67% more American homes than previously estimated face a high risk of flooding during the next 30 years. It could save your life and can save you money.

The Earth’s changing weather patterns make historic flood risk projections unreliable. If you are considering your home’s risk or a moving to a new location, add FloodFactor.com to your favorites to check your risk. According to First Street Foundation, there are “14.6 million properties across the country at substantial risk, of which 5.9 million properties and property owners are currently unaware of or underestimating the risk they face because they are not identified as being within the SFHA [Special Flood Hazard Area] zone.”

Take a moment to understand your flood risk now to improve your preparations.

Why Did the Risk Profile Change?

U.S. flood risk analysis is based on what happened in the past but changing weather patterns make backward-looking risk unreliable. Consider the experience of Houston, which endured three “500-year storms” within three years. Based on the old modeling of flood risk, this should never have happened.

The First Street Foundation’s flood assessment goes beyond the historical approach, which relied on insurance industry and Federal Emergency Management Agency records. When sea-level rise and extreme weather events are factored in, many more homes in low-lying areas and even desert communities like Pheonix, Arizona, turn out to be at risk of flooding. Led by a team of more than 80 well-regarded climate and data scientists, the FloodFactor project will continue to update its models to provide homeowners free access to flood risk information about 142 million properties.

Part of the problem with the old approach to flooding risk was the lack of property-specific information. FEMA risk assessments are developed by region without details about individual addresses in flood-prone areas. Likewise, insurers have focused on the damages paid in the past rather than the changing profile of weather in the United States. This resulted in many homeowners being caught by surprise when their homes were flooded and, in some regions, homes that previously faced little risk of flooding being under-insured against flooding.

The First Street Foundation describes the difference between perceived and actual risk as an information asymmetry that puts homeowners and landlords at a disadvantage.

First Street Foundation found that 67% more homes than previously thought are at risk of flooding in the next 30 years. Source

What Can You Do?

Looking closely at your neighborhood’s flood risk will help you prepare better for floods, as well as consider your property’s value. As the sea-levels rise, for example, there is no guarantee that your home will retain its current value. Imagine trying to sell your home when the bay or inlet on which you live is creeping toward your yard. The First Street research shows that seaside communities, including Virginia Beach, Virginia, and New Orleans, for instance, face very high flood risk; 36% for Virginia Beach, and 98% of homes in New Orleans are already prone to flood.

FloodFactor should be open whenever you are shopping for a new home. If a property faces increased flood risk from rising oceans, take it off your list. You’ll save time and it’s an easy way to avoid losing your capital. Insurers will not compensate fully if your home is lost to sea-level changes — if they pay anything. Likewise, homebuyers considering your home now have access to better information and for several years coastal property values fell where flooding threatens.

But coastal regions are just one aspect of flood risk. Run-off and river flooding threaten many more homes than previously estimated. First Street found increased flood risk in Idaho, Utah, and Arizona, among regions not normally considered flood regions. As heavy rainfall over shorter durations of time become more common, flash and river flooding will be more severe.

Use FloodFactor to examine the risk for your address. Consider how to block floodwaters, even a few inches that may accumulate due to your landscaping and penetrate the foundation of the house. Consider moving downspout outlets further from your home and look at how to landscape to keep water from pooling near the foundation. Check that gutters are clear and do not let the rain pour onto the ground next to the house. State Farm has ideas about how to prepare for flooding from heavy rains. And be sure to review your home insurance to ensure you have adequate flood insurance coverage.

The post U.S. Flood Risk Is 67% Higher Than Historic Projections — Check Your Address appeared first on Earth 911.